Significant uncertainty surrounds upcoming US import tariffs on imported solar panels and energy storage components. However, a recent Wood Mackenzie report ("All aboard the tariff coaster: implications for the US power industry") makes one consequence clear: these tariffs will significantly increase the cost of both solar power and battery energy storage in the US.

The US is already one of the world's most expensive markets for utility-scale solar. Wood Mackenzie warns that the projected tariffs will escalate these costs further. The firm believes that energy storage is facing the greatest impact.

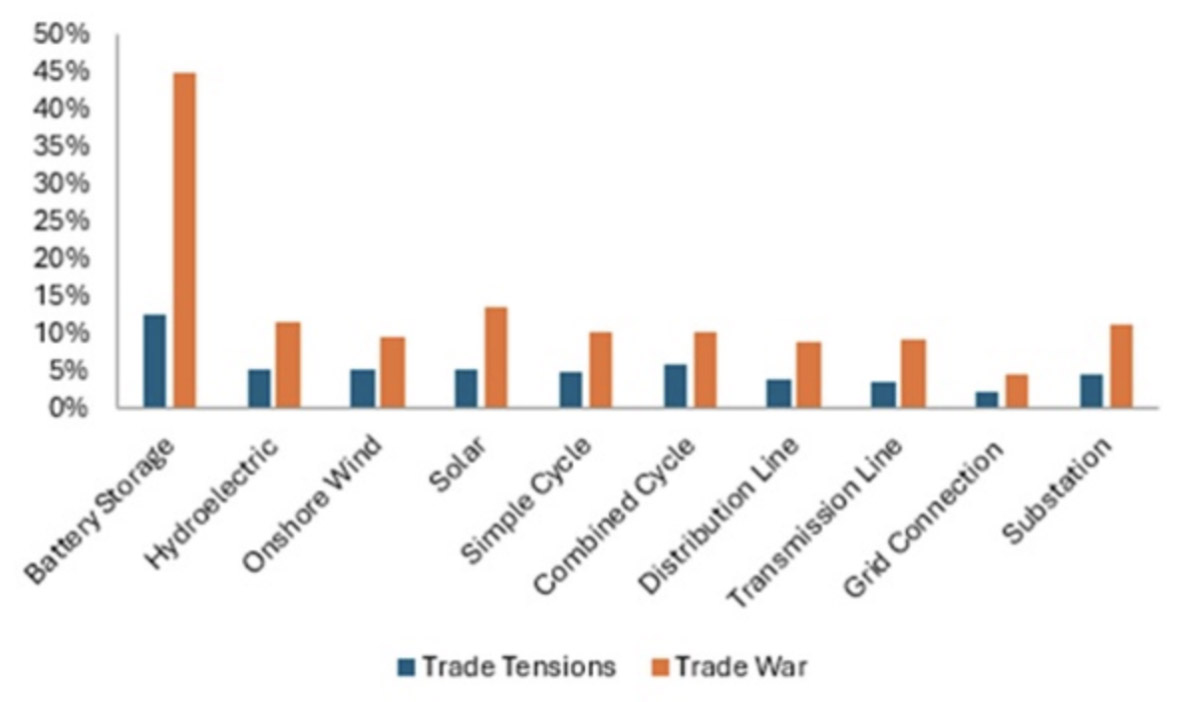

The report outlines two potential scenarios:

- ⭐ Trade Tensions (10-34% tariffs): Estimated to increase costs for most technologies by 6-11%.

- ⭐ Trade War (30% tariffs): Could see costs rise even higher.

1. Certain Cost Hikes Amid Tariff Uncertainty

Significantly, utility-scale battery storage is the exception. Due to heavy US reliance on imported lithium battery cells (especially from China), battery storage project costs could surge dramatically – by 12% to over 50% under the scenarios.

While US battery manufacturing is expanding, Wood Mackenzie estimates that domestic capacity will only meet about 6% of demand by 2025 and potentially 40% by 2030, leaving a significant dependence on imports vulnerable to tariffs.

2. Storage Hit Hardest, Solar Premiums Widen

Under two scenarios—Trade Tensions (10–34% tariffs) and Trade War (30% tariffs)—most technologies face 6–11% cost hikes. Solar power battery storage is the outlier due to import dependency.

Solar storage costs will also balloon: A U.S. utility-scale facility may cost 54% more than in Europe and 85% more than in China by 2026. Existing module tariffs and inefficient transmission policies already inflate U.S. solar expenses; new tariffs will deepen this premium for consumers.

3. Project Delays and Industry Disruption

US import Tariff uncertainty disrupts 5–10 year planning cycles, causing "massive uncertainty" for power industry players.

Wood Mackenzie expects project delays, higher Power Purchase Agreement (PPA) prices, and capital project impacts. Chris Seiple, the firm’s Power & Renewables Vice Chairman, warns these policies risk supply chain disruptions and slowed development. With costs and timelines in flux, the report predicts another slowdown in U.S. renewable project activity.

4. Conclusion: A Challenging Road Ahead

The looming US import tariffs by country threaten to hinder America's clean energy transition by increasing costs and creating uncertainty.

While domestic manufacturing is expanding, it won't meet demand soon, leaving the US dependent on imports - and vulnerable to price shocks. Policymakers must strike a balance between trade protections and affordability, or risk delaying renewable adoption.

For businesses, diversifying supply chains and locking in equipment costs early may help mitigate risks. Ultimately, without strategic adjustments, higher battery energy storage system prices could stall progress toward climate goals.

▲ Click Here To Stay Informed about the Latest Policies and News in the Solar Industry:https://www.youth-power.net/news/

▲ For any technical questions or inquiries regarding solar battery storage, please feel free to contact us at sales@youth-power.net.

Post time: Jun-20-2025