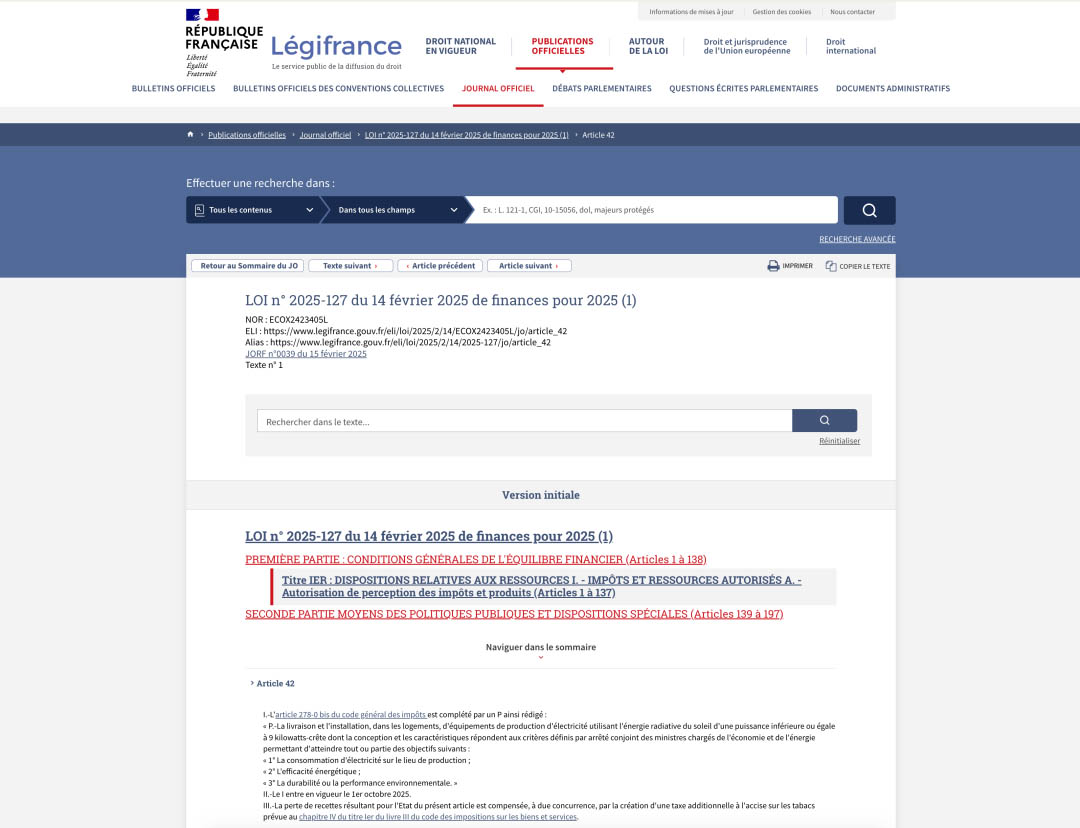

From October 1st, 2025, France plans to apply a reduced VAT rate of 5.5% on residential solar panel systems with a capacity below 9kW. This means that more households can install solar power at a lower cost. This tax cut is made possible by the EU's 2025 VAT rate freedom measures, which allow member states to apply reduced or zero rates on energy-saving materials to incentivize green investments.

1. Solar Policy Requirements

The specifics of the implementation have not been officially released yet. The following information is still in the draft stage and is expected to be submitted to France's High Energy Council for review on September 4, 2025.

>> Draft Requirements for Solar Panels Eligible for Reduced VAT

To qualify for this eco-friendly VAT reduction, solar panels must meet strict manufacturing standards, not just performance metrics. The specific requirements include:

- ⭐ Carbon Footprint: Below 530 kgCO₂ eq/kW

- ⭐ Silver Content: Below 14 mg/W.

- ⭐ Lead Content: Below 0.1%

- ⭐ Cadmium Content: Below 0.01%

These standards aim to steer the market towards solar modules with lower carbon emissions and reduced toxic metal content, promoting environmental sustainability.

>> Compliance Certification Requirements

Certification bodies must provide compliance certifications for the modules. Documentation must cover:

- ⭐ Traceability of production facilities for modules, battery cells, and wafers.

- ⭐ Evidence of factory audits conducted within the last 12 months.

- ⭐ Test results for the module's four key indicators (carbon footprint, silver, lead, cadmium).

The certification is valid for one year, ensuring regular oversight and quality control.

2. Other European countries have also introduced VAT incentives

France is not the only country implementing VAT reductions for solar PV. According to publicly available information, other European countries have also implemented similar measures.

|

Country |

Policy Period |

Policy Details |

|

Germany |

Since January 2023 |

Zero VAT rate applied to residential solar PV systems (≤30 kW). |

|

Austria |

From Jan 1, 2024 to Mar 31, 2025 |

Zero VAT rate applied to residential solar PV systems (≤35 kW). |

|

Belgium |

During 2022-2023 |

Reduced VAT rate of 6% (from standard 21%) for installing PV systems, heat pumps, etc., in residential buildings ≤10 years old. |

|

Netherlands |

Since January 1, 2023 |

Zero VAT rate on residential solar panels and their installation, and also exempt from VAT during net metering billing periods. |

|

UK |

From Apr 1, 2022 to Mar 31, 2027 |

Zero VAT rate on energy-saving materials including solar panels, energy storage, and heat pumps (applicable to residential installations). |

Stay informed about the latest updates in the solar and energy storage industry!

For more news and insights, visit us at: https://www.youth-power.net/news/

Post time: Sep-17-2025